Asset Tokenization and Logistics

Logistics of Tokenizing Assets and Commodities

The scope of opportunities offered by tokenizing your assets is truly remarkable and can definitely vie for dominance in its potential even with the outstanding possibilities offered by the tokenization of money. And that is only logical because money is an asset. Tokenizing assets implies emitting tokens that represent either a specific monetary value of a certain object or an item, be it a plane, a piece of machinery, a product in stock, or your right of ownership, your entitlement to a piece of property or to a share in a business. Tokenizing ownership rights completely transforms the legal mechanisms of property transfer and offers a limitless number of unique opportunities ranging from the new possibilities in terms of stock split to the new advantages in maintaining the anonymity of a right holder to providing a unique and effortless ability for owners to continuously transfer titles.

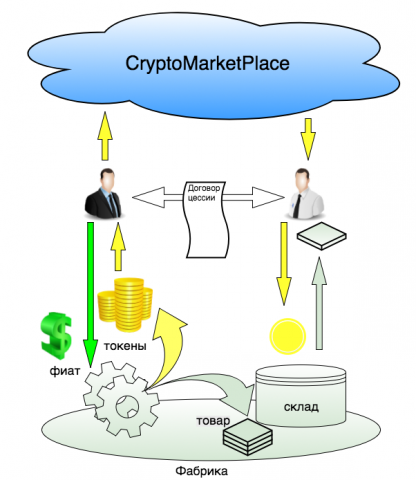

The tokenization of commodities offers a precise tool for transferring the ownership of a product at the very moment of its creation and for the subsequent multiple and virtually costless ownership transfers of the same product along the delivery line from its producer to its consumer. This poses a serious threat to the existing order of things in the movement of goods from a manufacturer to a buyer and in the resulting reverse flow of money.

For example, if Apple were to tokenize its iPhones, their sales mechanism would be profoundly transformed. The moment a new iPhone comes off the production line in China, it will acquire a token that will be permanently attached to it. The new token can be immediately offered for purchase on the company's website. Anyone - a consumer, a shop or an organization - can buy this token and instantaneously resell it multiple times until the ordered iPhone reaches its final buyer who will have to produce this token during the delivery of his iPhone as a confirmation of purchase.

You may find the proposed mechanism surreal and may even ask: "And what stops us from doing the same thing with fiat currencies?" The answer is simple: although utilizing fiat currencies does offer us the same opportunity of purchasing a product and subsequently reselling it, the transactions in this case are restricted by the movement of this product and the time it takes for it to travel from point A to point B. A resale of a product purchased with a fiat currency can take place only after the product reaches its buyer. The tokenization, however, does away with the limitations imposed by the time it takes to move the product and provides us with a much more flexible logistics mechanism that can handle effortlessly, effectively and instantaneously the commercial movement of commodities in the economic space.

Different kinds of assets require different kind of tokenization and that must be perfectly attuned to the unique characteristics and requirements of each commodity at hand. A mass production of identical goods requires one type of smart contract; products like sand, gravel or coffee are categorized and processed differently than the identical goods and, therefore, must be subject to another type of smart contract. And tokenizing unique goods like objects of art, parcels of land or second-hand real estate necessitates its own special handling. It is quite possible that in the future in order to fully realize the potential offered by tokenization of all commodities we will have to modify or completely transform the existing commercial infrastructures.

Nevertheless, the differences in types of commodities and assets affect only "the tuning aspect"of their respective tokens. The remaining requirements for the tokenization process - the blockchain itself, the miners that ensure the security and the validity of all transactions and the necessary legal footwork are almost always the same.

It is important to emphasize that, in general, commodity tokens in no way present problems that would put them conflict with the current legislation of the Russian Federation. Nor do they actually exist in conflict with the interests of the state and this fact will, no doubt, help to shape the future acts of legislation. In reality, commodity tokens can serve as units that represent the produced items for the record keeping of any company and, for the transactions carried out in fiat currencies, they can be used as the indicators of the delivery commitments made for the products, already paid for by the contracting parties.

The transfer of a commodity token from one owner to the next is similar to the bill of exchange transactions and can be legally viewed as a transfer of claim to a third party. Investing a commodity token with a right to transfer claim during the delivery of a product to the next agent in the commercial supply chain can bring the document control of a participating enterprise in compliance with the existing legislation. However, utilizing a cryptocurrency for the sale of commodity tokens by a producer of goods still needs to be legally defined and requires new legislation.

Tokenizing commodities in case of the already existing closing stock or in case of delays in the delivery schedule can be carried out by means of ICO financing. The initial ICO projects utilizing commodity tokens have already taken place, several similar projects are in the process of being developed. So far these projects have not run afoul of the Russian law and we can reasonably conclude that it is in the interests of the Russian state to look favorably on the enactment of the necessary legislation defining the legal status of cryptocurrencies and ICOs in Russia, provided that the bill rests on the solid legal footing.

Our team at Bit-Labs has developed a new method of commodity tokenization utilizing a set of specially designed adjustable parameters for the emission of several types of specialized tokens that can accurately represent a limited line of products. The project was created specifically for a company that produces oil heaters of various capacities. Utilizing scalability as one of the main principles in the development of this solution allowed us to create a valuable tool that will make the necessary adjustments and will calibrate the exact parameters for the emission of specialized tokens in accordance with the requirements that a new line of products may present to us in the future.

Introducing a token as a stock keeping unit will do away with the illegal uncertainties in this field; while developing a new structure for actively utilizing commodity tokens in the exchange trade will provide all producers of goods with a powerful infrastructure for setting up a profitable resale business in the secondary market. The emitted tokens will also guarantee the availability of products in stock for their immediate delivery.

Asset tokenization, also, has some interesting repercussion for e-commerce. It happens often nowadays that the the online shops run out of stock. A consumer selects an item in the Internet store, invests his time in placing an order only to discover later, to his great disappointment, that he wasted his time and that his item is no longer available for shipping. A commodity token, on the other hand, represents a guaranteed availability of any item on sale in the Internet store. It assures its clients that they will not spend their time and money in vain and that the product that they are ordering will in fact be shipping today. And this guarantee comes directly from the manufacturer of the product who has it available in stock.

If your company makes a product for which there exists high demand, then tokenizing your commodities will shorten a commercial supply chain for for your product to reach its buyer and you will not have to invest any money into building your own retail network. Any large wholesaler may fulfill this role by purchasing your tokens directly from you. All you have to do is emit a token for each item you produce and the rest is up to your wholesaler or an individual buyer who will take over these tokens from you.

Tokenization may also pose a risk to manufacturers in a situation where their wholesalers may decide to monopolize their business. As a result, a manufacturer may lose control over his distribution and sales, his enterprise may subsequently change owners or may even lose its independence and become a mere subsidiary of his wholesaler's business. Tokenization, thus, can be a dangerous weapon in the competitive struggle and influence in the market. But the companies that will tokenize their assets first will be the first to capitalize on their innovation. They will stand a better chance of wining competition and of positioning themselves center-stage in their respective industries just like Apple and Microsoft have done it before in the computer world.

For industrial manufacturers, tokenization may present cost-saving opportunities for optimizing their distribution network. In this case a token can play the role of a commodity-backed bill of exchange that guarantees the shipment of goods. Setting up your token to function this way may alllow them to tokenize not only the goods that have already been produced but also the goods that are to be produced in the future. Those commercial agents who have excess liquidity in heir hands may find themselves interested in purchasing this type of tokens for their subsequent resale to the final buyers. And the businesses that include in the emission of their tokens the stipulation for the delayed distribution of their product may use these tokens to finance their expansion and the introduction of new product lines.

We at Bit-Labs will be happy to work with you on tokenizing your assets and commodities. We will set up a team that will develop precisely calibrated tools catered specifically to your business needs. Please contact us.